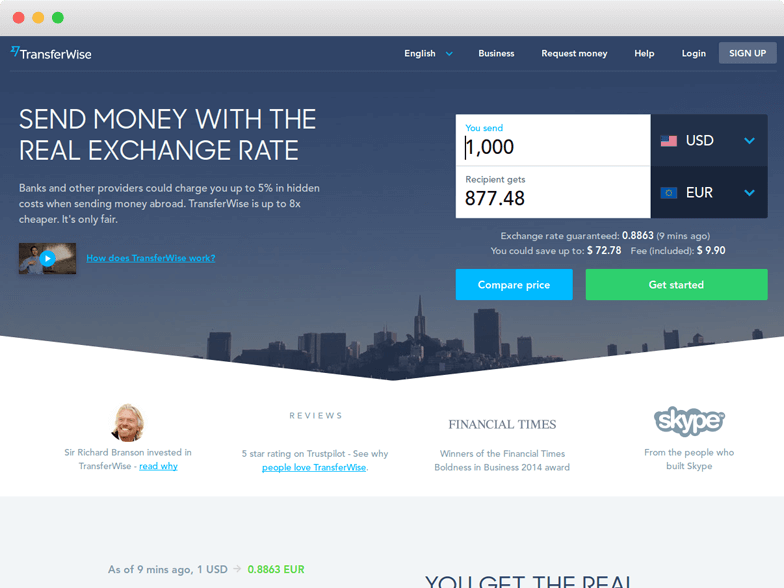

TransferWise is a highly user-oriented website. You will find many FAQs on its website which will clear all your doubts before you send your funds. TransferWise money transfer also offers mobile apps for the customer, so that one transfer money anywhere anytime without any delay.

When it comes to customer support, TransferWise contact details are provided for various countries on its website. It does not offer 24/7 customer support, but you can send the mail to them here. It also provides email and SMS services for their transaction details to its customers.

About payment convenience, it accepts various debit and credit cards, helps you in transferring funds through Facebook Messenger, and bank accounts. However, it does not support money market instruments, cryptocurrencies and savings accounts. So, customers who hold these instruments cannot use the services of TransferWise. It also does not offer cash pickup or courier services, so, there is no home delivery of your cash to the recipient. It will only place in the bank account of the recipient.

As per user experience, we rate 8 out of 10 to TransferWise support services. It’s because customers are not satisfied with its assistance facilities. We would have given it a higher score if the users have clear indications and understanding of their transactions.

TransferWise App:

TransferWise is offering both Android and iOS apps to its customers so that they can transact anytime, anywhere. It uses real-time currency exchange rates in its mobile apps also so that the user will get the idea if he wants to send money at this rate or not. TransferWise apps are highly secured, convenient and offer low-cost transfers so that customers get the best transfer experience.

TransferWise Android app is rated 4.6 stars out of 5 by the customers and TransferWise iOS app is rated 4.7 stars out of 5. This shows that the customers are highly satisfied with its transfer rates, security, app working and model. You need not log in for checking out the TransferWise transfer rates. You can download TransferWise apps here