Remitly is currently available in 3 countries to send money from, these are United states of America, Canada & United Kingdom. Remitly has recently started its services in United Kingdom.

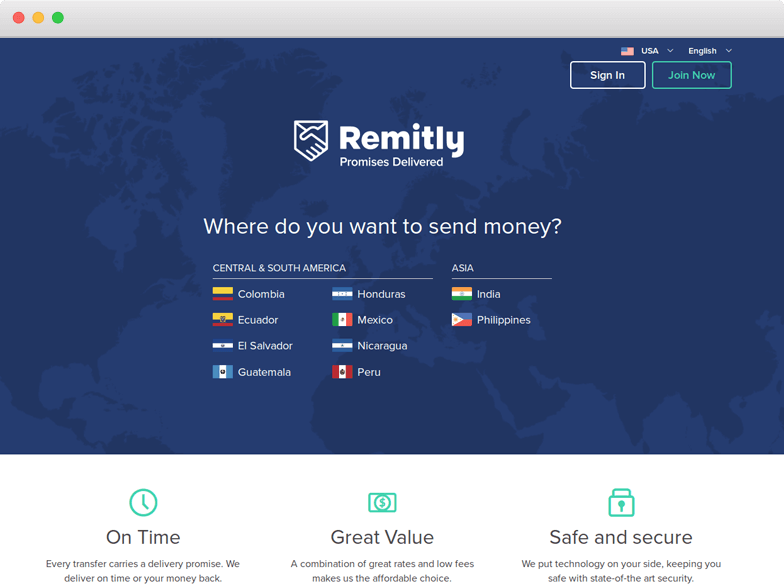

From USA it currently supports 8 Countries in Central & South America and 3 in Asia.

Receiving countries in Central & South America are Colombia, Ecuador, El Salvador, Guatmala, Honduras, Mexico, Nicaragua & Peru. You can send money to India, Philippines & China from USA as well.

From UK & Canada on the other hand you can only send the money to India, Philippines & China.

Remitly has also partnered with local banks & Cash Pickup partners in all the receiving countries to help users collect the money conveniently.

Remitly Partners in Philippines include over 10,000 cash Pickup locations and major banks. For India users can transfer funds to 100+ banks with instant deposits in HDFC & Axis bank and within 4 banking hours to ICICI, SBI and Citibank.

In Guatemala, El Salvador, Honduras, Nicaragua, Colombia, Ecuador and Peru, money can be deposited in major banks or can be picked up at thousands of local network partners

Remitly’s Mexico network includes pick up locations like Bancomer, Elektra, BanCoppel, Bansefi and all major banks in Mexico.