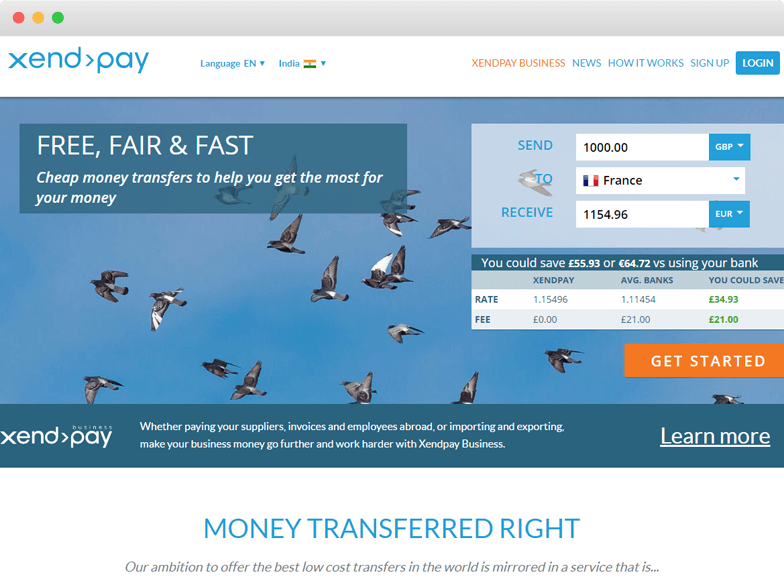

Xendpay Review- Uncluttered Way to Transfer Money 2024

Xendpay Review by Exchange Rate IQ

Every international money remittance company comes up with the goal of providing its services at low prices and offer better exchange rates than competitors. The same goal is made by Xendpay when Rajesh Agrawal founded it. But what matters is if it is working on its aims or not and therefore, the experts of Exchange Rate IQ have done an unbiased researched on Xendpay, its services, customer satisfaction and reliability.

Xendpay is an international money transfer company which has been backed by RationalFX, its sister concern. The company was founded by Mr Rajesh Agrawal, an Indian migrant and ethical entrepreneur. Its goal is to provide international money transfer services at reduced cost to millions of migrants around the world. Some significant benefits of Xendpay are:- Xendpay Exchange Rates are Highly Competitive

- Pay What You Want as Fee

- Global Transfer Access

- Multilingual Customer Support

Review of Xendpay :

Founded in the year 2011 under RationalFX, which initially provides foreign exchange and wire transfer, Xendpay aims to cut down the expenses of money transfer. It is a UK-based company which offers services in 205 countries in 51 currencies with more than 2968 currency pairs. Xendpay is a PSD agent and registered with the Information Commissioner’s Office under the Data Protection Act, 2018.

The company offer both personal and business transfers, where it has launched “Pay What You Want” model of the fee. Here the fee applies on personal transfers is up to £2,000 per annum or its equivalent in other currencies. For the increased limit of business transfer, the rate is up to £4,000 per annum. Under this feature, Xendpay suggests currency exchange fees, where you ultimately decide how much you pay. Once you have exceeded these limits, you have to start paying nominal fees.

Xendpay has been providing customer assistance to its users in the business hours in various countries, according to their timings. It does not offer 24*7 customer assistance to the users.

Pricing : How much does Xendpay cost?

Transfer Fee

Xendpay has a unique feature of “Pay What You Want” for its users. Here they can pay up to £2,000 per annum or its equivalent in other currencies for free. Above that, it charges a low transfer fee depending on the currency and country you are sending funds to. In most of the cases, the fee is in between 0.45% to 1.40% of the total amount. While in the business transfers, clients can pay up to £4,000 per annum. Above it, they have to pay the nominal fee, as asked by the company.

Xendpay Exchange Rate

The exchange rates offered by Xendpay is tended to be stronger than most of the banks and other money remittance companies.

Any Other Fee

If the clients are sending money to any mobile wallet, then they have to pay a higher fee which also includes the delivery fees other than a transfer fee. If the payment is made through credit card, then you have to pay 1.7% fee if you are in Europe and 2.6% from other parts of the world. However, the debit card payments are free in Europe, while cost 2.6% in rest of the world.

Xendpay scores 7 out of 10 from Exchange Rate IQ as it is not one of the cheapest options available and also does not offer any promo codes to its users.

Transparency: Does Xendpay have any hidden fees?

Hidden Fee

Once you enter the amount in your currency, Xendpay will change it in the currency you want to send to, without any hidden fee. It will also provide the details of the fees that you need to pay while doing the transfer once you choose the sending option.

Tracking Details

Xendpay provides notification for every stage of the transfer through email. You will receive the notifications when Xendpay receives the money and also when the funds are delivered to the recipient. Besides this, one cannot cancel the orders once placed unless you contact the customer care before the end of one business day.

As per experts of Exchange Rate IQ, Xendpay has no hidden fee and excellent tracking procedure but does not provide on-click cancellations; therefore, it deserves 7 out of 10 in this head.

Transfer Speed: How long does it take to send money through Xendpay?

The time by which the recipient has received money varies on Xendpay. It all depends on the mode of payment as well as currency and country you are paying money to.

Generally, Euro (EUR), Great Britain Pound (GBP), and the United States Dollar (USD) are sent to the recipient on the same day, except in the case of the weekend. If the payment is made after 2 PM British Time, then it is possible that the banks will not process on the same day. So, the recipient will receive the money on the next working day.

In other currencies and countries, the recipient will receive the amount in 3-5 working days, depending on the working hours of the countries as well as banks. This is a long time, and therefore, Exchange Rate IQ provides it 6 out of 10 rating.

Coverage: How many Countries & Currencies does Xendpay support?

With Xendpay, one can transfer to 205 countries in 51 currencies which also include Nigeria, Kenya and the Philippines. One can send money through the bank account, cards or directly to the mobile wallet.

It also offers SOFORT payments in Austria, Belgium, Czech Republic, France, Germany, Hungary, Italy, Netherlands, Poland, Slovakia, Spain, Switzerland and the UK. SOFORT is a real-time bank transfer payment which can be used to transfer funds directly to merchant by shoppers. Some other countries where Xendpay sends money to are provided in the table:

Countries Supported by Xendpay

| Japan | India | Pakistan | Mauritius | China |

| Costa Rica | Qatar | Nepal | New Zealand | Brazil |

| Canada | Bulgaria | Norway | Vietnam | Jordan |

| Hungary | Hong Kong | Ghana | South Korea | South Africa and more |

Currencies Supported by Xendpay

Some of the currencies which are supported by Xendpay are:

| GBP | INR | YEN | USD |

| EUR | HUF | KES | ZAR |

| AED | AUD | DKK | BBD and more |

The company is covering many countries of Asia, Europe and the Americas, but not of Africa. So it has still many countries to cover where it can grow and provide its services worldwide. Hence, we provide 8 out of 10 for its currency and countries coverage.

Xendpay Transfer Process

How does Xendpay work?

Go to the website of Xendpay.

In the mid of the home page, you will find “Send Money Now”.

You will be redirected to a new page.

Here if you are an existing user, log in. If you are a new user, then sign up.

After signing up, enter all the personal details.

Select the type of account personal or business.

Enter the bank account or any card details.

Enter the recipient details.

Re-check all the details and make the payment.

Track the details of your transfer on the dashboard.

User experience of Xendpay

Xendpay is a money remittance company which offer great rates and little fee for sending money till a particular limit. It is a part of Rational Group and sister concern of RationalFX. Xendpay has a very high percentage of excellent reviews by its customers. Some of the various positive and negative points of Xendpay listed by customers are:

Positive:

- Its pay what you want option.

- It has been highly secured which includes 256-bit SSL encryption with a 2048-bit signature.

- iPhone App (you can download Xendpay App here)

Negative:

- No android app is available.

- Slow transfer speed.

- Very limited payment and delivery options.

With Xendpay Money Transfer, one can send money from the debit card, credit card, and bank account. It also supports SOFORT payments in some of the countries. It does not accept crypto currencies, money market instruments and SWIFT transfers. One can send money from $1 to $9,000 before verification. After verification, one can send up to $100,000 yearly.

Xendpay Customer Support

If we talk about the Xendpay contact and customer assistance, then it is not offering 24/7 services, but offer in different countries according to their business hours. These details are listed in the table below:

| Language | Phone number | Hours of Operation |

|---|---|---|

| English | +44 (0)20 7220 8158 | 8:30am to 5:30pm GMT (Monday to Friday, excluding UK Bank holidays) |

| French | +33(0)3 59360102 | 9:30am to 6:30pm CET (Monday to Friday, excluding UK Bank Holidays) |

| +44 (0)20 7220 8195 | 9:30am to 6:30pm CET (Monday to Friday, excluding UK Bank Holidays) |

Besides all this, the company has been offering its website in five different languages. This includes English, French, German, Spanish and Polish. It offers personal and business transfers but not charity, where it can expand its business growth.

On overall user experience, Exchange Rate IQ’s experts rate Xendpay 8 out of 10. So, if you are looking for transferring money through Xendpay login here.

Security : Is Xendpay Safe?

Cybersecurity is one of the most important features of the online remittance service providers. Similar is Xendpay, which is using the same technology and security as online banking systems.

- It acts as an agent to RationalFX, which is regulated by the UK Financial Conduct Authority (FCA).

- It is also registered with Her Majesty’s Revenue and Customs (HMRC).

- It uses secure web site protocol called SSL as a server.

If anyone is making the card payment, then all the security code and password are hidden, encrypted and not visible to Xendpay. RationalFX has also appointed Money Laundering Reporting Officer (MLRO). All this security is good, but it has not been providing any physical security, so that we will rate 8 out of 10 to Xendpay.

Transfer Type And Modes

Pay In Options

| Bank |

| Credit Card |

| Debit Card |

| Mobile Money |

Pay Out Options

| Bank |

| Mobile Money |

Service Mode

|

Online

|

Exchange Rate Type

| Fixed |

Xendpay FAQ's

Does Xendpay have its own mobile apps?

Yes. Xendpay is providing an iOS mobile app which you can download here. However, it is not offering an Android app so android users need to make payments from a web browser only.

What are the charges for sending money via XendPay?

XendPay has a unique ‘Pay What You Want’ feature that enables you to pay flexible amounts of fees. For a start, they do recommend a minimum transfer fee of £3.50 which you can change when making a transfer. They then charge fees for up to £2000 for personal transfers and £4000 for business transfers on an annual basis. In most cases, XendPay charges a fee that falls in between 0.45% to 1.40% of the total amount you wish to send. This amount is equivalently paid in any currency.

What are the minimum and maximum sending limits of Xendpay?

Xendpay has a high maximum transfer limit, which allows its customers to transfer more money in once.

Xendpay minimum transfer limit: USD$1

Xendpay maximum transfer limit: £100,000

If you are making a card payment, you are allowed to send £5,000 in a single transaction.

How can I start sending money via XendPay?

Sending money is just as easy as a few clicks. For a start, you have to pick the amount you want to send and where you want to send it to. Next, you will be obliged to pay what you want as the transaction fee. Note that you will incur some extra fees if you are paying by card and the country you are paying from. After making your payment, XendPay tracking allows you to monitor your transaction from your dashboard and make sure that your money arrives safely to its destination.

Which documents I need to submit to Xendpay for verifying account?

You need to submit address proof and one identity proof which are issued by the government. Once your account will be verified, you can transfer higher amount.

How long can it take to send money with XendPay?

The transfer speeds that XendPay offers is dependent on the mode of payment you choose as well as the country you are sending your money to. The EUR, GBP and the USD are sent to your recipient on the same day except if it is the weekend. In other currencies, the transfer usually takes 3-5 working days depending on the working hours of the country.

Which countries are supported by XendPay for making international transfers?

Once can send money to 205 countries in 51 currencies across the globe. This transfer you can make via the bank account, credit or debit cards and as cash directly to your mobile wallet. To check if your country is eligible for a transfer, you can check their quote form for more details.

Can I change my recipient’s details once the transaction is confirmed?

Upon confirming your transfer, you cannot change your recipient’s details. This is for security reasons and your own personal benefit. In such a case, you are required to cancel your transaction and create a new one with the correct recipient details. From your dashboard, you can also create a new beneficiary and delete the wrong one.

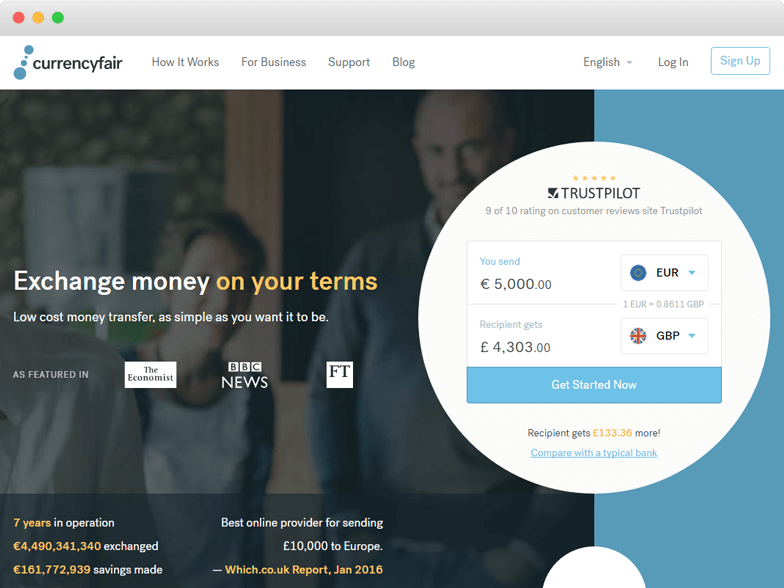

Alternatives to Xendpay

Xendpay User Reviews and Ratings

Good and it was great

Good and it was great

XendPay and Rational Foreign Exchange Ltd go into administration

Further to my previous review a few days ago, just in case people are not aware, it has just been announced today that both XendPay and it's sister company which processed the funds (Rational Foreign Exchange Ltd) have 'entered administration' due to declaring themselves insolvent. Here is the pub "On 29 November 2023, Rational Foreign Exchange Limited (RFX) entered special administration under the Payment and Electronic Money Institution Insolvency Regulations 2021. Ed Boyle and Kristina Kicks of Interpath Ltd have been appointed joint special administrators (JSAs)". "A PSD Agent of the firm, Xendpay Limited – which is under common ownership – also entered administration at the same time. The affairs of that firm are being managed by the same insolvency practitioners, Ed Boyle and Kristina Kicks of Interpath Ltd". You should Google 'Rational Foreign Exchange Limited enters special administration' to read the published story by the FCA. You should all read as it explains whom to contact and how to apply for return of your funds (as they were 'safeguarded') in the event of the Company collapsing. Hope this helps!

Need response from Xendpay

Need response from Xendpay Funds stuck and website down. Xendpay, you need to respond soon if you dont want to get your rating affected with negative reviews here. Send an update to your customers and save yourself.

I recently made a money transfer…

I recently made a money transfer through Xendpay; however, I am now encountering difficulties accessing the website as it appears to be blocked. This situation is causing me some concern. Could any one assist in providing clarity or support in resolving this matter promptly?