ExpressSend by Wells Fargo Review- A Secure and Reliable Money Transfer Service 2024

Wells Fargo Review by Exchange Rate IQ

With Wells Fargo ExpressSend, one can send minimum of $25 to 13 countries in online and offline mode. But before using its services, it is also necessary to know if you can trust its services or not? How much it charge for transferring fees and making profit? All these answers have been answered by the experts of Exchange Rate IQ who have provided an independent and unbiased review of Wells Fargo ExpressSend.

Wells Fargo offers money transfer services to individuals across 13 countries in Latin America and Asia through ExpressSend. The company offers other transfer services also including wire transfer and Zello, and one can use Sello to transact in the US only. If you wish to transfer money for business purposes, then you have to transfer through the wire transfer or foreign bank draft services of Wells Fargo. Some of the benefits of using its services are:

- Highly trusted banking brand

- Multiple transfer options

- Send directly from your bank account

Review of Wells Fargo :

Launched in the year 1995, Wells Fargo ExpressSend lets you send money directly to a bank account or for cash pickup. However, it’s only available for recipients in Mexico, Asia, South America, Central America and the Caribbean where you can send a minimum of USD $25 and have multiple daily transfer limits for various countries, these are:

Wells Fargo ExpressSend Transfer Limit

| Country | Maximum Limit |

|---|---|

| Mexico | Cash Pick-Up: $1,000 / Credit to Account: $1,500 |

| Dominican Republic | Cash Pick-Up: $1,500 |

| El Salvador | Cash Pick-Up: $1,000 / Credit to Account: $1,500 |

| Guatemala | Cash Pick-Up: $1,500 |

| Honduras | Cash Pick-Up: $1,500 |

| Nicaragua | Cash Pick-Up: $1,500 |

| Colombia | Cash Pick-Up: $1,500 / Credit to Account: $1,500 |

| Ecuador | Cash Pick-Up: $1,000 |

| Peru | Cash Pick-Up: $500 |

| China | Credit to Account: $1,500 |

| India | Credit to Account: $ 5,000 |

| Philippines | Cash Pick-Up: $1,000 / Credit to Account: $3,000 |

| Vietnam | Credit to Account: $ 5,000 |

The company offers multiple transfer options which include bank transfer, wire transfer, online transfer, and cash pick-up. It is also providing 24/7 customer service assistance so that one can contact it anytime. It is also highly secured so that one needs not to worry about their privacy policy.

So, on an overall basis, the experts of Exchange Rate IQ provide it 7.5 out of 10.

Pricing : How much does Wells Fargo cost?

Wells Fargo ExpressSend Transfer Fee

The company charges different fees depending on the countries where you are transferring the funds. It does not charge any fee for opening account and maintaining it, but you have to pay the transaction fee. For example, if you send USD $1,000 to China, then it will charge USD $8, while if you send the same amount to India, then it will not charge any transfer fee.

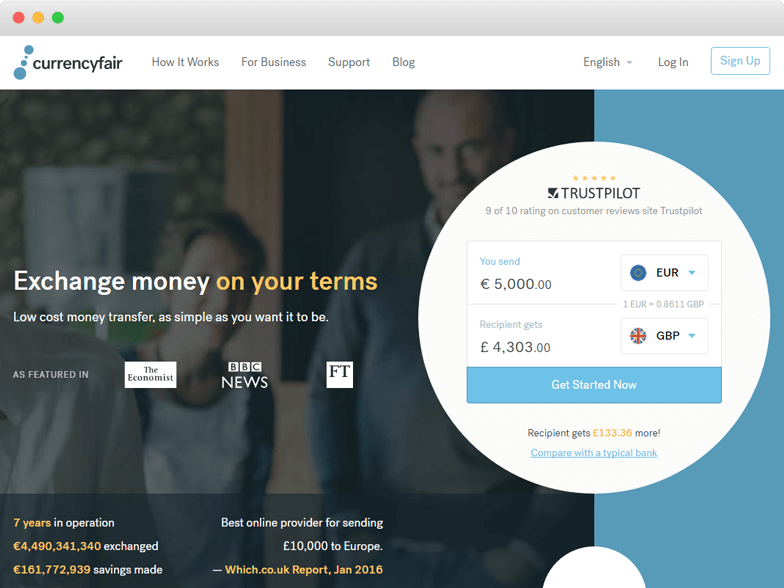

Wells Fargo ExpressSend Exchange Rate

The company’s exchange rates are lower than that of the live market price and many of its competitors, as it makes money while transferring the funds. So, you will get better rates from other competitors compared to Wells Fargo. The more money you send, better the exchange rate you will get.

Any Other Fee:

No, there is not any other fee charged by the company, but the intermediary bank may charge some fee depending on that bank and country’s policies.

So, under the pricing head, we rate Wells Fargo’s ExpressSend 7 out of 10, because there are many companies which are offering better rates and transfer funds at a minimum fee. If you want to check how much fee it will charge in other countries, you can check at ExpressSend Remittance Cost Estimator.

Transparency: Does Wells Fargo have any hidden fees?

ExpressSend Wells Fargo Hidden Fee:

The company makes money while transferring the funds and this might attract some hidden fees, which charges by the company during the transaction.

ExpressSend Wells Fargo Tracking Details:

One can track the transactions make by Zelle, wire transfers or ExpressSend on their dashboard. There is no regular tracking number or procedure.

So, under this head, we rate Wells Fargo money transfer service 7 out of 10.

Transfer Speed: How long does it take to send money through Wells Fargo?

The transfer speed for transferring funds from Wells Fargo differs according to the process you are sending money to. There are:

Zelle: As it offers transfer to the US only, it will take approximately 2 days.

Wires: If you are transferring funds from this mode, it will transfer funds on the same day in the US, but takes 1-2 business days or more depending on the country.

ExpressSend: In this transfer service, money will be received by the recipient on the same business day for many locations.

So, for transfer speed, we rate it 8 out of 10, because many companies even offer instant transfers.

Coverage: How many Countries & Currencies does Wells Fargo support?

The company offers transfer from the United States of America to multiple countries through a bank account or online transfers. These countries are:

- China

- Colombia

- Dominican Republic

- India

- Ecuador

- El Salvador

- Guatemala

- Vietnam

- Philippines

- Peru

- Mexico

- Honduras

- Nicaragua

The recipients can receive the funds in bank accounts and in some of the countries, it is also offering cash pick-up services. The banks where you can transfer the funds in the above-listed companies are:

- Philippines – Bank of the Philippine Islands, BDO Unibank, Metrobank, Philippine National Bank,

- Lhuillier, Cebuana Lhuillier

- India – ICICI Bank, HDFC Bank, Axis Bank

- Vietnam – Vietinbank, Vietcombank

- China – Agricultural Bank of China

So, for its coverage, we rate Wells Fargo ExpressSend services 6 out of 10, because it is offering its services in a few countries only, while there are many other companies which are offering its services worldwide. For using the services of ExpressSend Money Transfer by Wells Fargo login here.

Wells Fargo Transfer Process

Step-By-Step Guide to transfer funds with Wells Fargo

Go to the Wells Fargo website.

Click on “Personal” at the top of the home page and bring curser at “Banking and Cards” head.

Here click on “Global Remittance Services”.

Read all the details of sending money and click on “Send Money Now” at the bottom of the page.

Here either login or enroll yourself.

Enter all the details as asked by the company for enrolling.

Enter the details of recipient.

Enter the amount and confirm the transfer.

User experience of Wells Fargo

Wells Fargo international money transfer service ExpressSend is offering its services from the past 20 years in 13 countries across the world. It is mainly designed for individuals who want to send money to their family and friends. Some of the positive and negative aspects of using the Wells Fargo transfer services are:

Positive:

- 24/7 customer support available

- Highly secured

- Cash pick-up services available in many countries

Negative:

- Not offering services worldwide

- Not offering fast transfers to businesses

- Higher than average costs compared to other companies

ExpressSend Customer Support:

The company is offering 24/7 customer support to its users.

ExpressSend customer service number: 1-800-556-0605 (24 hours a day, 7 days a week)

ExpressSend Mobile Apps

One can send the funds by using Wells Fargo mobile apps, which you can download here.

ExpressSend Referral Benefits:

The company provides a unique link to users to send it to friends. When they start using the services of Wells Fargo money transfer and made the first payment through it, the company will provide referral benefits to both the users.

ExpressSend Promo Code:

The company provides promo code to users by sharing it with them through notification, email and SMS. By using these promo codes you can reduce the transfer fee.

Besides all this, if a user wants to send money to multiple people through ExpressSend, then he/she need to open a separate Wells Fargo ExpressSend Service Agreement. You cannot send the funds through single Wells Fargo ExpressSend Service Agreement. There is also a limit of the number of beneficiaries; you can only add 4 beneficiaries.

So, by keeping all the multiple factors in mind, we rate 7 out of 10 to the user experience of Wells Fargo. For started using the services of Wells Fargo ExpressSend sign up here.

Security : Is Wells Fargo Safe?

The company is offering safe transfers of the funds from bank account to bank account, cash pick-up or online and wire transfer form. Its privacy technology are same as many banks of the US. ExpressSend by Wells Fargo follows various privacy policies to offer best services to its customers.

Therefore, we rate it 9 out of 10 for its privacy policies and security measures.

Transfer Type And Modes

Pay In Options

| Cash |

| Bank |

Pay Out Options

| Cash |

| Bank |

Service Mode

|

Online

|

Exchange Rate Type

| Fixed |

Wells Fargo FAQ's

How can I make my account with Wells Fargo ExpressSend?

You can simply contact the customer service of Wells Fargo and ask them to create an account on your behalf. You can also provide your beneficiary’s details to the company so that you can process the money transfer faster.

Can I send money to more than one beneficiary through Wells Fargo ExpressSend?

Yes. You can send money to more than one beneficiary through Wells Fargo International Money Transfer; however, you will need to open a separate Wells Fargo ExpressSend Service Agreement for it.

Does Wells Fargo ExpressSend offer business transfers?

No, Wells Fargo does not offer business transfer, so an individual can only send funds to their family and friends through it.

Alternatives to Wells Fargo

Wells Fargo User Reviews and Ratings

How a bank operates without managers at…

How a bank operates without managers at customer service! Wells Fargo is becoming like a zoo. no at Wells Fargo knows what he is doing and no one at wells Fargo is regulated or supervised. itis just a jungle where the employees are doing what they please without control of managers. Notice do not waste your time requesting to speak to a manager, The managers do not exist any more.

2 days, 264 min wasting time, NO RESULTS!

My wire transfer from Wells Fargo to Citi Bank was inexplicably halted. I tried calling wire services six times, each time waiting over 40 minutes. Today, when I finally got through, the representative, Jasmin, hung up on me after I told her I had been waiting 44 minutes. Consequently, the money was deducted from my account, but the recipient company never received it! It's been two days, and I still haven't received an explanation. Every representative promises to investigate and call back, but they never do! Is this what you call customer care? How am I supposed to use your services? This is unacceptable!

The mobile app is not available for…

The mobile app is not available for Samsung S24 FE or from what I can tell from the review....its not available on Android. To add insult to injury - you can't transfer money from Wells Fargo to any Australian bank. We must be a 3rd world country or Wells Fargo is very parochial. Needless to say - my account will be closing shortly.

I have been a credit card customer wit…

I have been a credit card customer with Wells Fargo for years. Pay on time, no late payments on my own ( glitch in system said I was late, but proof I wasn’t). In July 2024, had a severe accident and almost died. Was hospitalized for over a month. Came home to it burglarized, a vehicle in need of repair, mounting medical bills, no way to rehab or appts, unable to walk but a few steps. I applied for refi of my home through a company and was approved with a credit score of 744. No late payments or other issues noted. Was good enough for refi company but was told to finish a couple of repairs I had started before final appraisal could be completed and a final credit check. Told not to close any credit cards or have any downgraded. A couple of weeks ago, received notice that Wells Fargo was downgrading my credit. Late payments (which they admitted not my fault), high amounts on my credit cards. Well yes - had to buy materials to complete the repairs on house, trying to replace stolen items (ac window unit, clothes, pots/pans, almost all of my groceries, medications, tools, vehicle battery, bedding, towels and other things). No problem with the re fi bank - but problem with wf. I’m 71, failing health because unable to go to appointments or rehab, fiercely independent up til July. Wells Fargo doing this has destroyed me as the re fi was my last straw to be debt free with all of my cards paid off and enough money to live off of for the rest of my days with no more use for credit cards. But thanks to Wells Fargo, they became my last straw and have ruined the time I have left. Without my vehicle and far away from town, I’m cut off from medical access and medication as I used the card partly for my life saving meds. I appealed to the highest authority there and lost. Wells Fargo was the last of thinnest threads I was hanging onto. That thread quickly unraveling as all of this has been for nothing. My obituary will be sent to them. Should I live long enough to pay them off, I’ll never use them again

Compare Wells Fargo With Other Money Transfer Companies

Wells Fargo Company & Contact Info

| Address:- | San Francisco, California, United States |

| Email:- | [email protected] |

| Phone:- | 1-800-556-0605 |

| Social Links:- |

|

| Apps |

|