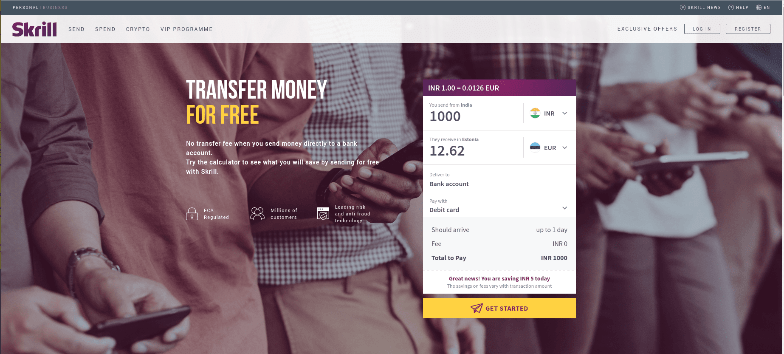

Skrill Money Transfer service helps you by sending money internationally. Founded in 2001, Skrill works under the Paysafe Group, an online payment service provider through in-person or other channels. Skrill offers attractive pricing, fees and exchange rates. Depending on currency and country, you can transfer money through debit card, bank transfer, credit card, and SOFORT banking services.

The company offers Skrill to Skrill service and Skrill Money Transfer services for transferring money abroad. Opening an account with Skrill allows access of Skrill wallet and Skrill Money transfer service.

Some of the benefits of Skrill are:

Offers reasonable exchange rate and fees

Provides a fast, secure and convenient way to transfer money

Receive money directly into the bank account

Review of Skrill :

Through Skrill Money transfer platform, you can send money to a mobile wallet or bank account directly. To transfer the money to the recipient’s account, you will need account details, address, and the recipient's name. Transferring money from this platform is quite simple, you just need to open a Skrill account with the company and transfer money from the website using the “Send” option.

You can send money from a bank account or credit card to bank account and mobile wallet. Skrill mobile application can also assist you in sending money to a bank account. Considering the customer feedback, it is one of the high rated platforms offering money transfer service. Apart from this, it also offers exchange rates and fees at competitive pricing.

Skrill charges a fixed sum of money to withdraw funds using the services of the company for a particular country. There is no fee when you receive money but have to pay while withdrawing it. The fixed fee for withdrawing money varies from country to country. Such as, it doesn’t charge anything in the US, and charges £4.76 as a fixed fee for transferring to a domestic and international bank account. They charge additionally to send money to Skrill account holders. You will also pay 5 euros a month for inactivity charges if you do not access your account once in a year. Skrill charges 3.99% below the interbank baseline rate for Skrill to Skrill transfer. The banks also charge for transferring money which is not included in Skill charges.

Users can transfer money from the following countries:

United Kingdom, Turkey, Andorra, United Arab Emirates, Tunisia, Australia, Austria, Belgium, Bulgaria, Bahrain, Canada, Switzerland, Colombia, Cyprus, Czech Republic, Germany, South Korea, Luxembourg, Saudi Arabia, Denmark, Singapore, Spain, Hong Kong, Malta, Estonia, Malaysia, Finland, Iceland, France, Greece, Serbia, Croatia, Hungary, India, Morocco, Ireland, Israel, Italy, Jordan, Slovenia, Kuwait, Lithuania, Portugal, Sweden, Thailand, Latvia, Netherlands, Norway, New Zealand, Oman, Poland, Qatar, Romania, San Marino, Slovakia, Taiwan, and South Africa.

The money can be sent to Austria, India, United Kingdom, Australia, Bangladesh, Belgium, Cyprus, Estonia, Finland, France, San Marino, Philippines, Monaco, Luxembourg, Germany, Portugal, Thailand, Greece, Indonesia, Sri Lanka, Malaysia, Ireland, Slovenia, Italy, Netherlands, Kenya, Latvia, Vietnam, Malta, Nepal, Slovakia, Poland, Spain.