MoneyGram Review- Best Way to Transfer Funds Anywhere 2024

MoneyGram Review by Exchange Rate IQ

Is sending money with MoneyGram easy? How much it cost? Is it safer option comparing to other international remittance companies? It is necessary to get the answers of all these questions before started using the services of MoneyGram. Therefore, the experts of ERIQ have reviewed the company and provide you every possible detail in the precise form. The company offer flexible payment option and have more than 350,000 agent locations across the globe.

MoneyGram International Inc. is a US-based money remittance company with its headquarters in Dallas, Texas. It is 2nd largest money transfer company in the world after Western Union. The company helps people to send and receive cash within minutes in over 350,000 agent locations across over 200 countries and territories. It offers both online as well as offline transfers for personal and business purposes. Some of the benefits of using MoneyGram services are:

- Multiple Transfer Options

- Variety of Services Offered

- Multilingual Website

- Faster Transfers to MoneyGram Plus Users

Review of MoneyGram :

MoneyGram is a global service provider of money transfer and other payment services which are available in 200 countries and territories. The businesses of the company are divided into two categories: Global Funds Transfers and Financial Paper Products. It offers various services other than fund transfers are:

- Transfer money to mobile wallets

- Pay bills

- Make healthcare and child support payments

- Send money to inmates in federal, state, and county correctional facilities

- Load prepaid cards

- Purchase money orders

The company has a minimum transfer limit of USD $1 and one can transfer the maximum amount up to USD $6,000. This is a daily maximum transfer limit, so one cannot send more than $6,000 in a day. Besides this, it offers MoneyGram Plus services to its users, where they will get more benefits including fast transfers, email notifications as well as personalised offers which will reduce the transfer fee.

The customer services of the company are available 24*7, so, users can anytime contact the company regarding transfers and payment related queries. One can also request for MoneyGram refund as it provides 100% refund in 7-10 business days.

MoneyGram is highly secured, so one can use its services worry-free.

On an overall basis, we rate it 8 out of 10 because it has a lower maximum transfer limit, which is a major drawback.

Pricing : How much does MoneyGram cost?

MoneyGram Transfer Fee

The company charges $11.00 if you are transferring funds from a bank account and $49.99 if the amount is transferred through debit or credit card. Besides this, it takes approximately 2% of the total amount transferred. In the cash transfers, it has additional charges because it reaches the recipient in minutes after transfer.

MoneyGram Exchange Rate

The company offers mid-market exchange rates to its customers. It applies the standard practice of taking a margin on the exchange rate where mid-market exchange rates may exceed up to 5% occasionally. So, MoneyGram rates are basically lower than many of its competitors.

Any Other Fee:

The company may ask for various fees depending on the country and currency of the recipient as well as sender. You can check all the fees here at MoneyGram Fees calculator.

So, for its pricing policy, we rate it 7 out of 10 because there are many companies which offer lower fees and better exchange rates with no margins of profit.

Transparency: Does MoneyGram have any hidden fees?

MoneyGram Hidden Fee

The company is offering highly transparent services and does not charge any hidden fees. The company locks exchange rate once you start the transaction and the same amount will be received by the recipient.

MoneyGram Tracking Details

For tracking the transaction process with MoneyGram, you need to enter the reference number or authorization number as well as your last name after which you will get where your amount has reached. You can track your MoneyGram transfer here.

So, for MoneyGram’s transparency, experts of Exchange Rate IQ have given 10 out of 10.

Transfer Speed: How long does it take to send money through MoneyGram?

MoneyGram Money Transfer speed depends on the destination country, receiving bank and its working hours. Still, if you are making the transfer through a bank account, then it will approximately 3-5 working days. While if you have transferred funds through a MoneyGram agent location, it will be received by the recipient in minutes (available in working hours only).

It offers fast transactions to MoneyGram Plus holders, but that will also take up to 1 working day.

So, for the transferring speed, we rate it 7 out of 10.

Coverage: How many Countries & Currencies does MoneyGram support?

The company has an experience of 80 years and about 2500 employees are working for it. MoneyGram is providing sending and receiving money services to 200 countries with more than 350,000 agent locations. One can send money online to over 20 countries through the mobile app, or website using debit or credit card or bank account. In the USA and Canada, users can also send funds through Interac online.

Countries Supported by MoneyGram

| Albania | Benin | Comoros | Kosovo | Mayotte |

| Anguilla | Bhutan | Djibouti | Lesotho | Nigeria |

| Aruba | Cape Verde | Eritrea | Malawi | Reunion |

| Gabon | Uzbekistan | Senegal | Suriname | Timor-Leste |

The company has more than 25,000 agent locations in Africa alone. Besides this, you can also find MoneyGram locations near you here. For using the online services of MoneyGram login here. We rate it 8 out of 10 for its coverage, because there are still many countries which are needed to be covered by the company.

MoneyGram Transfer Process

Send money online or cash pick up with MoneyGram

Go to the MoneyGram website.

You need to log in or sign up for transferring funds and knowing the fees as well as exchange rates.

Enter all the details asked by the company for registering.

Enter the details of the bank account.

Enter the recipient’s details.

Enter the amount by selecting the currency of your and beneficiary.

Re-check all the details and send the funds.

Track the transfers at your dashboard anytime anywhere.

User experience of MoneyGram

MoneyGram is a highly user-oriented website where you just need to register to transfer your funds either through a bank account, debit card, credit card or cash pickup. It is offering services worldwide with the help of its transfer agents and collaborating with multiple banks. At the same time, the website is available in multiple languages so that users can get the information in their languages. Some of the positive and negative aspects of Money Gram are:

Positive:

- Easy cash pickups across the globe.

- Flexible transfers which can be received in a bank account, mobile wallets or cash

- Best option for urgent transfers through cash pickup

Negative:

- Lower maximum transfer limit

- High fees on the currency exchange rate

- Only debit card, credit card and cash transfer options available for the users outside US and Canada.

MoneyGram Customer Service:

The company is offering 24*7 customer assistance and you can call them at the following numbers:

MoneyGram Phone Number

General Questions: 1-800-666-3947

About a Transaction: 1-800-922-7146

Report Fraud: 1-800-926-9400

You can also fill MoneyGram online form here to get a call back from the company.

MoneyGram Mobile Apps

The company is offering its mobile apps so that one can transfer funds whenever they want no matters where they are. You can download these apps here:

MoneyGram Refer a Friend

The company provides cash benefits if you share a unique link provided by the company to your friends and they make the first payment with a minimum amount of $50.

MoneyGram Promo Codes

The company provides its promo codes to users by notifications, email or SMS. They can use these promo codes to get discount on the transfer fee.

The company has also provided FAQs for the general customer questions, besides this, it has been providing worldwide services for businesses or personal transfers. So, on overall user experience, we rate it 7 out of 10. So, for starting the services of MoneyGram sign up here.

Security : Is MoneyGram Safe?

So, your first question before using the services of MoneyGram would be, is it safe? Then you will be happy to know that the company is subject to a wide range of laws and regulations across the world.

- The company is licensed in all the 50 states, the District of Columbia, Puerto Rico, the US Virgin Islands and Guam.

- In the UK, it is licensed as an Authorized Payment Institution under the European Union Payment Services Directive.

- Many other jurisdictions also provided the license to MoneyGram to work in various countries.

So, the company is highly secured and has become the second largest fund transfer provider in the world with its best services. Hence we rate it 10 out of 10 under the security head.

Transfer Type And Modes

Pay In Options

| Bank |

| Cash |

| Credit Card |

| Debit Card |

Pay Out Options

| Bank |

| Cash |

| Home Delivery |

Service Mode

|

Online

At Branch

|

Exchange Rate Type

| Fixed |

| Indicative |

MoneyGram FAQ's

Can I send money through mobile phone or apps of MoneyGram?

Can I cancel money transfer from MoneyGram?

What are the multiple transfer options available in MoneyGram?

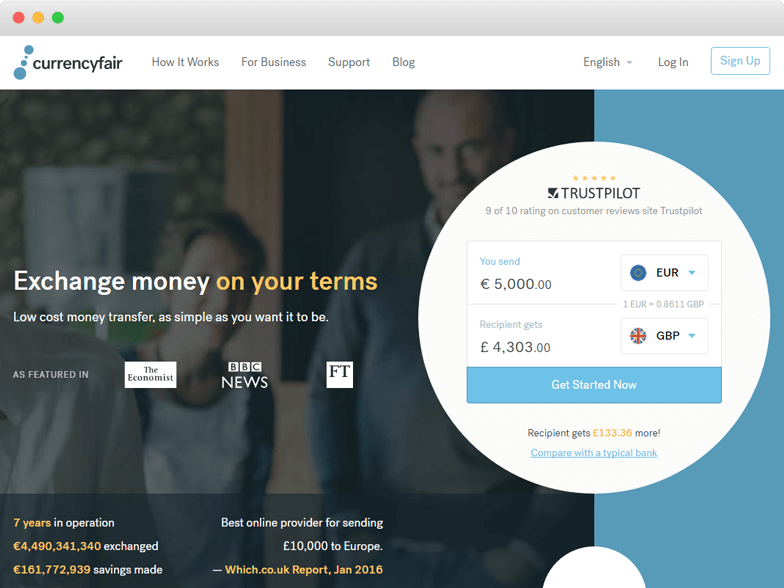

Alternatives to MoneyGram

Compare MoneyGram With Other Money Transfer Companies

MoneyGram Company & Contact Info

| Address:- | Dallas, Texas, United States |

| Email:- | [email protected] |

| Phone:- | 1-800-955-7777 |

| Social Links:- |

|

| Apps |

|