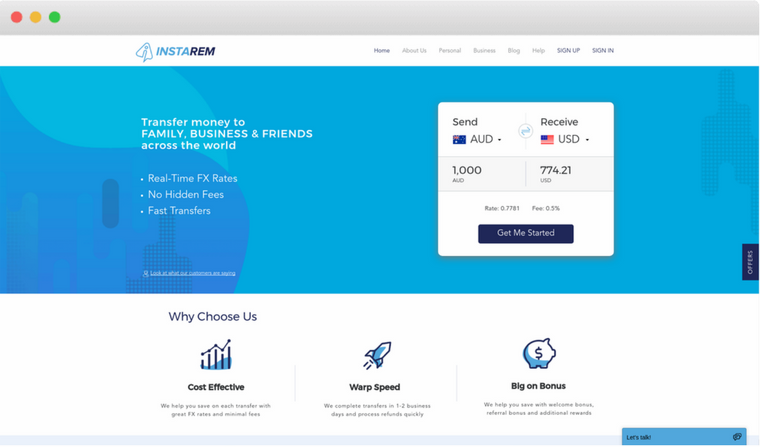

InstaReM Review- Cost-Effective Way to Remit Money 2024

InstaReM Review by Exchange Rate IQ

We know you have multiple questions, such as is InstaReM safe? Is it has good fees and exchange rate? Can you trust it with your money? How to transfer money using InstaReM? Therefore, we have bought you an unbiased review of InstaReM which has been completed after a lot of research, customer satisfaction and reliability. InstaReM which is also called Instant Remittance offers its services in most of the Asian countries.

InstaReM is a short form of instant remittance which offers fast and low-priced currency transfer, especially in Asian countries. People using InstaReM can transfer funds from 60+ countries to more than 25 countries. One can register for personal and business purposes for using its services. Some of the benefits of using the services of InstaReM are:

- Simple Registration Process

- Highly Transparent Fee Structure

Review of InstaReM :

Launched in the year 2014, InstaReM has its headquarters in Singapore which offers digital cross-border money transfers to both individuals and businesses. Currently, the company is offering its services in 60+ countries with major countries of Asia in over 22 currencies.

The company has another product naming, InstaReM MassPay which helps in managing the bulk payments to multiple beneficiaries in multiple currencies. The company has been recognized by the Singapore Fintech Festival and India Fintech Awards in 2017. One can transfer a minimum of INR 500 from InstaReM with no maximum limit. Some of the limits that have been set by the company, according to regulations are:

- INR 3.40 Lakh (Max Limit Per Transaction - For all purposes except Overseas Education)

- INR 6.80 Lakh (Max Limit Per Transaction - If the reason for transfer is Overseas Education)

- INR 17.00 Lakh (Max Limit Per Financial Year, i.e., April 1 to March 31)

However, there are no limits for business transfers in most of the countries where InstaReM is serving.

InstaReM India is not providing 24*7 customer assistance, but one can contact them at the time provided by the company. It has also been using the best security measures to provide worry-free transfer services to users.

We overall rate 7.5 out of 10 to InstaReM.

Pricing : How much does InstaReM cost?

InstaReM Transfer Fee

InstaReM charges different fees in different countries. It charges around 0.5% for transfers in Hong Kong and Australia, and 0.25% for transferring money from Singapore. In India, InstaReM charges around 0.25% to 1.00%, depending on the country you are sending money to and the mode you choose.

InstaReM Exchange Rates

InstaReM offers Zero margin FX rates* which are much higher than any of the banks. So, you will get the live market prices to transfer the currency to any other country. Besides this, one can also get the rate alerts from InstaReM in various currencies. If you also need to start the alerts then click here.

Any Other Fee

InstaReM does not have any other fee, but if you transact with the credit card, you may have to pay extra because many credit card companies charge for using their services.

Many other competitors of InstaReM are even offering free transfers, so if we look at the transfer fee of the company, we feel it a bit costlier. Therefore, we rate it 8 out of 10 in the pricing section.

(*applicable only for certain currencies and certain trading hours)

Transparency: Does InstaReM have any hidden fees?

InstaReM Hidden Fee

InstaReM does not have any hidden fees. The recipient will receive the amount that has been shown by the company during the transaction and no other fee will be deducted from the amount.

InstaReM Tracking Details

One can track the transfer done on InstaReM on its home page. You will find the track transfer head, where you have to enter the transaction number as well as the registered mobile number. After submitting, you will get the details of your transaction, and in how much time it will be received in the recipient account.

One can transfer a minimum of INR 4,000 from India with different maximum limits. However, one can send up to INR 17 Lakhs in a financial year, which is a regulatory limit.

So, as we see that the company is not having any hidden fees as well as simple tracking procedure, experts of Exchange Rate IQ give it 9 out of 10 in the transparency section.

Transfer Speed: How long does it take to send money through InstaReM?

InstaReM transfer time is variable and it solely depends on the country from where you are sending the money and the recipients’ country. It can transfer funds in 24 hours across Asia while taking an average 2-4 days for transferring funds in other parts of the world.

The company has been partnering with 8,000+ banks and reaches about 3.25 million people for transferring the funds in 60+ countries.

Well, many companies offer instant transfer, but the same is not offered by InstaReM, therefore, we rate it 7 out of 10 for its transferring speed.

Coverage: How many Countries & Currencies does InstaReM support?

InstaReM is covering about 60+ countries across the world and has a network of 8000+ banks in 55+ countries. It offers multi-currency transfers from AUD, EUR, MYR, INR, USD, SGD and HKD. By using the services of InstaReM, one can send money to the following countries.

| USA | Canada | Australia | Bangladesh | China | Austria |

| Belgium | Hong Kong | India | Denmark | Estonia | Indonesia |

| Malaysia | Finland | France | Nepal | Philippines | Germany |

| Greece | Singapore | South Korea | Ireland | Italy | Sri Lanka |

| Thailand | Luxembourg | Malta | Vietnam | Netherland | Portugal |

| Spain | UK |

One can transfer the funds from InstaReM through bank transfers, online transfers, ACH transfer and wire transfer. The company is not offering airtime top-up, cash pick-up and courier services to its customers. From India, it allows transfers to Australia, Canada, the Euro Zone, the UK, the US, and Singapore currently. One can send money to:

- Friends or family

- Payments for a mortgage in another country

- Pay bills from another country

- Pay international tuition fees

- Buy a new home and pay for it

- Pay to employees or suppliers overseas

The company also does not allow third-party payment, one-off transfers and forward contracts. Therefore, for its coverage, we provide InstaReM 7 out of 10, because it still has vast opportunities to grow and provide it accessible to people across the world.

InstaReM Promo Codes & Offers

InstaReM Transfer Process

How to transfer money using InstaReM?

Go to the InstaReM website.

Select the country you want to send funds to and enter the amount you want to send.

It will show you the amount that will be received by the fund, and the fees you need to pay.

Click on “Register With Us”.

Here you will be redirected to a new page, InstaReM Sign up.

Select that you want an individual or business account.

Enter the email and password as well as the country you stay in.

Enter all other personal details of yours as well as the recipient.

Enter the amount that you want to send.

Re-check the recipient details.

Sent the funds and track the same by tracking number provided by the company after the transaction.

User experience of InstaReM

InstaReM is an online money remittance company which is offering its services in 60+ countries and especially in Asian countries and Australia. As per users, the company is offering low commission and fixed fee transfers, which is highly beneficial for the small transfers. Some of the positive and negative points of InstaReM from the customer point of view are:

Positive:

- Competitive exchange rates

- Specialized services to small and medium businesses

- Transparent and up-front pricing with no hidden fee

Negative:

- Limited availability

- Does not accept cash as well as third-party payments

- Minimum fee applicable to all the transactions

InstaReM App:

The company has been providing both Android and iOS apps so that you can transfer funds from anywhere. You can download the apps here:

InstaReM Customer Care:

InstaReM has been providing assistance services to its customers via call and email. You can contact them from Mon to Fri 9:00 am to 9:00 pm IST and Sat to Sun 8:00 am to 11:30 am IST.

InstaReM contact number: 0008009190542

InstaReM email address: [email protected]

InstaReM Offers:

InstaReM offer coupons time to time to provide cash backs as well as free transfers to the users. InstaReM first transfer coupon code which customers can use is “SAVEMORE”, where they can get up to INR 300 discount.

InstaReM Referral:

The company offers referral benefits to its customers. If you refer the services through a unique link provided by the company to any of your friends, you will receive 400 InstaPoints, while your friend will get 475 InstaPoints (75 welcome bonus + 400 referral points) once they complete the first transaction. You can redeem these points in the next transfer (only 400 points can be redeemed in one transaction).

The company also offers cancellation services on clicks, but one may not get the refund if the amount has already been transferred to the recipient’s account. InstaReM is an alternative option against many banks who charge more for transferring funds overseas. The company is cost-effective for small transferors but have to pay more fees on larger amounts. Therefore, we rate 8 out of 10 to it a user experience basis. So, if you want to start the transaction with InstaReM log in here.

Security : Is InstaReM Safe?

In the world of cyber crimes and attacks, it is very much essential to increase the security to minimize as well as control the damage. So, InstaReM is licensed in various countries, including the EU, Australia, India, Canada, Hong Kong, Malaysia, and Singapore. Besides this, if you are using the company for transacting with it, it will use the ID proofs provided by the government, including license, Pancard, or any other proof of identity and proof of address.

InstaReM also monitors various devices by which the users are using the website or app and monitor traffic patterns so that it can protect the website from any cybercrime. It is also registered with other authorities in the US, Australia, Canada, and Singapore.

We can see that the company is highly secured and use various measures to protect the data of users from any cybercrime. It has also been using good manpower to track any unethical activities on its website. So, we provide it 10 out of 10 ranking for its security measures.

InstaReM Exchange Rate

Transfer Type And Modes

Pay In Options

| Bank |

Pay Out Options

| Bank |

Service Mode

|

Online

|

Exchange Rate Type

| Fixed |

InstaReM FAQ's

Can I send money through mobile phones or tab using InstaReM?

No. you will need web browser as the company is not offering its Android app and iOS app. So if you are using the service of InstaReM, you can send money through browser only.

How wide is the Instarem country coverage?

Whether you are in Dhaka in Bangladesh or visiting the busy streets of Hanoi in Vietnam, you will need a money transfer company to make your remittances easier. Instarem is one money transfer service provider that makes this easier for you to send money to more than 60 countries across the globe and in 55 plus different currencies. To know if the country you want to send your money to is eligible for instarem transfers, visit their official page and locate it.

Can I pay using debit or credit card on InstaReM?

InstaReM does not accept any of the cards, either debit or credit. So you cannot pay using them but only transfer amount using your bank account. You can make a direct bank payment using the POLi system in Australia and made SWIFT payments in the US.

How much will I be charged for using Instarem?

When using Instarem, you can incur low charges for high transfer speeds. Instarem does not have any hidden fees as its users value its transparency. To narrow down on it, Instarem charges different fees in different countries. For instance, when sending money to Singapore, you will be charged 0.25% of your total transfer money. Hong Kong and Australia will accrue 0.5%. Basically Instarem fees range from 0.25% to 1%.

How much time it will take to reach funds to the recipient?

It mostly takes 24 hours to reach the funds to the recipients in most of the Asian countries as the company is partnered with over 8000+ banks in 60+ countries. However, in other countries it may take 2-4 working days.

Is my money safe with Instarem? Is Instarem tracking legit?

You do not have to worry about your money getting mishandled or lost when using Instarem. First and foremost, the verification process they gives you enough guarantee that you are working with a trusted service provider. In addition to that, they are transparent and Instarem tracking services occasionally sends you feedback via text or email depending on a feedback mechanism of your approval.

Does InstaReM refund amount after cancelling transaction?

Yes. InstaReM refunds the amount if you cancel the transaction by contacting the team of InstaReM through email or call. Without informing the customer service within 24 hours of cancelling the transaction, you will not be able to get the refund.

Can I get a refund after cancelling a transaction?

Yes, indeed you can get a refund after cancelling an ongoing transaction with Instarem. You can do so by contacting their team through email at [email protected] or via a call. Their set condition however is that you should make contact within 24 hours of making your transaction. If you do not cancel the transaction within this duration, then the chances of getting your refunds become minimal.

How are the transfer speeds with Instarem?

Instarem has varying transfer speeds depending on the country in which you are transferring your money to. For money transfers across Asia, your money will take averagely 24 hours to reach its recipient. On the other hand when sending money to other parts of the world, Instarem takes roughly 2-4 days to convey your cash. This is averagely fair if you compare them with banks that are not only slow but also costly.

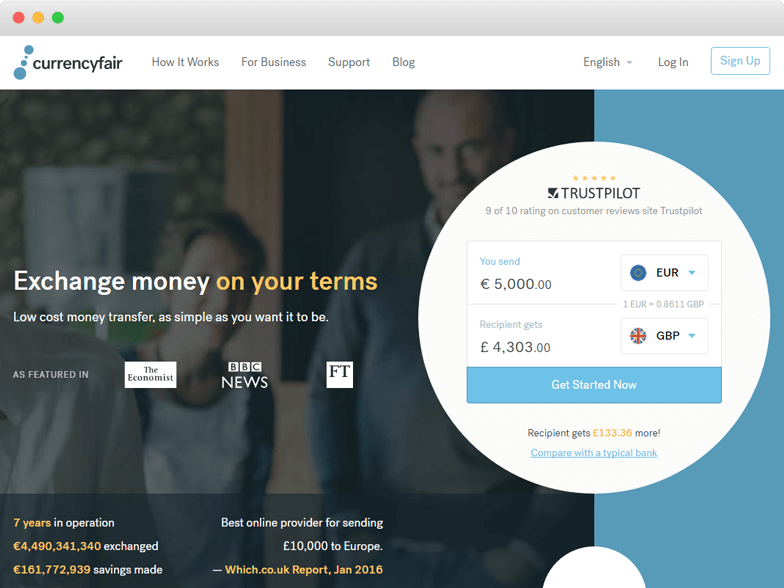

Alternatives to InstaReM

InstaReM User Reviews and Ratings

Good UI experience

Good UI experience

I've had a great experience with…

I've had a great experience with InstaRem. Their customer support is brilliant and very prompt. The people fronting the chat interface are knowledgeable and solution oriented. I'll definitely be a regular user for all my future forex remit transactions.

Good reliable service

Good reliable service

Excellent

able to send ontime when ever required.

Compare InstaReM With Other Money Transfer Companies

InstaReM Company & Contact Info

| Address:- | 1201-1205, B-Wing, Kanakia Wall Street, Andheri - Kurla Rd, Chakala, Andheri East, Mumbai, Maharashtra 400092 |

| Email:- | [email protected] |

| Phone:- | 0008009190542 |

| Social Links:- |

|

| Apps |

|