Three Reasons for International Money Transfer

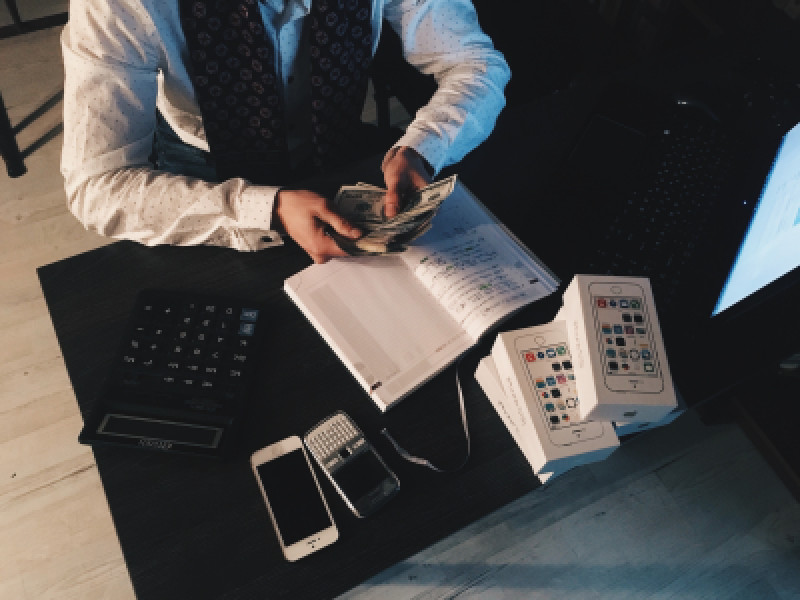

When do you need to transfer money?

There are so many reasons why one needs to send mone...

What Is The Best Way To Send Money Internationally?

Suppose there is one question that has no definite answer, then it has to be, the best way to send money inte...

Read More

10 Commnets

Top Money Transfer Apps Features to Look Out For

If you want to send money internationally today, be rest assured that you are likely to use ...

Read More

1 Commnets

How to Find a Cheap Way to Send Money Abroad

When it comes to international money transfer, everyone wants to get the best deal there is. With se...

Read More

1 Commnets