Although money transfer is a very basic transaction, it has become an integral part of the world economy. Remittance has become a billion-dollar industry today. However, there are many financial institutions and agencies that offer services to individuals to transfer their money from one point to another via electronic mode, paper mode and even delivered at the doorstep.

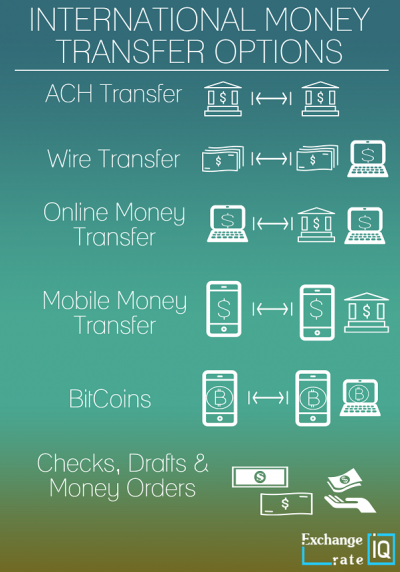

We have listed below the most common and talked-about methods of money transfer and tried to explain how it works in the background.

Send money using Wire Transfer:

Wire transfer is one of the fastest ways to send money. Since the involved Banks or financial institutions have a mutual agreement between them it allows for the money transfer to take place faster. The wire transfer process is coordinated by SWIFT (Society for Worldwide Interbank Financial Telecommunication) messages between banks and money transfer operators.

Since the transaction is happening between 2 financial institutions they tend to charge heavy fees to send and receive money. But this also results in a faster money transfer.

In wire transfer, funds are typically moved between bank accounts by money transfer operators (MTO). The information about the receiver and receiver’s bank account is gathered by MTO from the sender. Once the information is gathered the sender MTO initiates a wire transfer thus sending a message to the receiving bank or financial institution

The sender needs access to the following information only, before sending the money:

- Recipient Information: Name, address and the account number

- Recipient’s bank Information: The SWIFT (Society For Worldwide Interbank Financial Telecommunications) code, IFSC (Indian Financial System Code) or IBAN (International Bank Account Number)

How does wire transfer work?

Now, Wire transfer doesn’t necessarily need to take place from bank account to bank account. Western Union and MoneyGram are Money transfer companies that make use of wire transfer with its funds. When you go to their branch, you can send money using a cash wire transfer. The process is pretty straight forward, take the money to the approved MTO counter, pay the fee, get the verification code and share it with the receiving party in the other country. In such transactions, money could reach the receiver within 10 minutes.

And because of such fast speeds, Wire transfer fees vary according to money transfer service you are using and typically depends on the time of transfer. The faster the transfer the more expensive it ought to be. Typically MTOs and banks charge between $20 and $35 to send money, and in certain case between $10 and $20 to receive money.

Send money using ACH Money Transfer:

ACH stands for Automated Clearing House, which is an electronic network used by financial institutions to process transactions in batches. The clearinghouse essentially acts as the middle man, receiving the payments, clearing the payment and then informing the bank or financial institution. Banks also offer ACH Transfer as a mode to transfer money domestically and internationally.

Even though the movement of funds happens between banks and credit unions, however unlike online/wire transfers, an ACH transfer goes through an Automated Clearing House (ACH) network. ACH network is a group of financial institutions that acts as financial hub helping people move money from one bank to another.

In the United States, NACHA (National Automated Clearing House Association) manages the ACH network of transactions for all US banks. Similarly, in Europe, we have SEPA or the Single Euro Payments Area. It is the equivalent of ACH & consists of 35 participating countries. “Direct Entry” is the Australian equivalent of ACH.

The sender initiates direct payment using ACH network, the sender’s bank takes the transaction and batches it together with the other ACH transactions to be sent out at regular times throughout the day.

The ACH operator receiving the batch of the ACH transactions sorts the batch and makes the transactions available for the receiving institutions. The recipient's bank account receives the transaction and the fund is available for the recipient to use. Since there is a clearing exchange involved, the processing time is usually more than the usual online/wire transfer.As a result, your money is not available as quickly as it often is with a wire transfer. The ACH process is more convenient and less expensive, but it also takes a little bit longer

Send money online

Online money transfer essentially constitutes all money transfer transactions that could be initiated online and without visiting a bank or branch. Today almost all major banks and Money transfer operators offer their clients user-friendly banking facilities of online money transfer services. This has helped the clientele a lot in carrying out international transactions with a click of the button. The main reasons to send money via an online money transfer service are undeniable: Online money transfer is fast, convenient and safe. Online money transfer has become the most convenient way of transferring money from one country to another. The transaction takes place between sending and receiving banks in case of online transfer, whereas in case of wire transfer there are other money transfer operators like Western Union, MoneyGram acting as an intermediary to send money to an overseas banking account.

We have many different models for online money transfer, most banks now offer this service where you log in to your online account, enter the information of the recipient bank account and transfer money. The back end process is essentially the same wire or ACH transfer. In some cases, banks give you both options and you can choose wire transfer or ACH depending on your requirement of time and fees. Other variation online money transfers is where independent companies have created websites where you can create your account, add your bank accounts or debit card and trigger a transfer. Again you need to provide the recipient’s bank account details. These companies, in turn, collect money from your bank account and work with partner banks to transfer money on your behalf. Xoom is an example of one such service and even traditional players like Moneygram and Western Union now offer the same.

We also had some innovative ideas that came in with the advent of the internet era and Paypal was launched. Paypal essentially was created on the idea of revolutionizing money transfer by using email id as the unique identity between the sending and receiving party. Paypal created a virtual network within which a user could transfer money instantly by loading cash on an online account from your bank account or credit card. Once within the Paypal network, the transactions are instant between Paypal users. In order to access your money, however, you need to withdraw it to your bank account – which could take some time to clear, or you can spend it using a Paypal credit card. Sending money using Paypal is very easy, convenient and fast but could get a little expensive when doing an international money transfer. Online Money transfer is by far the fastest-growing market for remittances since it is the most convenient method to send money to your loved ones across the globe. A lot of new companies like Transferwise, Remitly, Worldremit are building great customer experiences and breaking the barriers and rules of traditional, slow and inefficient systems built by banks. The next step from online transfer looks pretty clear and that is providing the speed and efficiency on the mobile devices.

Send money using Mobile Money transfers

Money transfer is one of the fastest evolving areas today. A lot of different models are being built with the mobile being widely available. Considering the reach of mobile in the developing world, a lot of people see mobiles as an obvious choice for money transfer. With the emergence of smartphones, people are now able to use various apps and online services even in remote areas. In developing world however some successful business models have emerged around sending money using the text messages (SMS) Instead of sending money with cash, cheque, or credit cards, a consumer can use a mobile phone to send money.

Besides the new models of mobile wallets and using text to send money all Major money transfer companies, as well as banks, have created user-friendly mobile apps and users can now send money on the go using these apps. A lot of new Mobile wallets based services are also coming up. These wallets essentially create a network of users and after loading the money in the wallet, one can transfer money to another person or from 1 wallet to another. Once the money is transferred to wallet it could be used to buy goods or services online or in stores. Alternatively, the receiver can choose to transfer money from the mobile wallet back to a bank account. Zenbanx is one recent example that is aggressively gaining ground in the money transfer industry.

Money Transfer using Bitcoins:

Bitcoin is a form of digital currency, created and held electronically. Transactions are made peer to peer with no banks in between There are no transaction fees and the whole transaction is anonymous. Bitcoins are stored in a “digital wallet,” which exists either in the cloud or on a user’s computer. The wallet is a kind of virtual bank account that allows users to send or receive bitcoins, pay for goods or save their money. Once users have installed a Bitcoin wallet on your computer or mobile phone, it will generate a Bitcoin address and one can create more whenever they need one. Users can then disclose these addresses to friends or family so that they can transfer bitcoins or vice versa. This works pretty similar to email, with the exception that Bitcoin addresses should only be used once.

The idea of bitcoin remittance or Remittance, as some are calling it, has been gaining a lot of grounds but many different startups trying to experiment with it and coming up with new model and services every day. A major player with a substantial service in this field is yet to emerge. A lot of sceptics of bitcoin money transfer feel that bitcoins could definitely help in the speed of transfer but the jury is still out on whether it would be able to stand up to the reach, cost-effectiveness and the ease of use that traditional fiat money based money transfer services offer.

Checks, Drafts & Money Order:

This mode is by far the safest and most common mode to send money internationally. This comprises of money orders, drafts and checks, which we would like to refer to as tangible substances (in relation to money transfer services). These are used as a safe alternative to sending cash itself. International money orders are the most convenient and secure way to send money internationally. Money orders can be cashed at many cashing locations or can be easily deposited into the bank account. To cash the check, it requires is a relevant government authorized Identity Proof. Money orders are available at banks, credit unions, post offices, check cashing locations like Western Union and MoneyGram as well as at retail stores like Wal-Mart. Purchasing a money order is also easy, it does not require an individual to hold a checking account. You can pay for your money order with cash, debit card, or traveller’s checks.

The other common modes are Bank drafts and Cashier’s Check, which are safer than a personal check. In order to purchase, one needs to go to the bank directly and hand them the cash in order for them to issue a cashier’s check, or the amount can be drafted directly from the bank account in case of bank drafts. The bank will request for receiver’s name and address and will write the check in the receiver’s name. Bank Drafts and Cashier's Checks are available across any bank. With this mode, there is a fee charged with the services and also it may take some time to cash. However, this method of money transfer is traceable in case the instrument does not reach the required destination. Therefore this method is considered more economical mode albeit time-consuming. Since Drafts/Checks are mailed via any mail system, so the amount of time that this takes depends on the mail system and the destination country.

Hawala Money Transfer

Hawala, hundi or so-called “underground banking” is an alternative remittance system or an informal value transfer system that is often associated used by migrant to avoid the hefty fees and hassles of the formal money transfer options. In this method of transferring money, there is no actual movement of funds. One definition from Interpol is that Hawala is "money transfer without money movement." Hawaladars or Hawala dealers, arrange money transfers that are solely based on trust, family connections and or regional relationships. These third parties are usually immigrants and workers who want to send a small sum of money to their homeland, avoiding bank fees.

Under this system, in most cases, funds actually do not flow from one country to another. Rather a systematic netting off happens between the parties that are willing to transfer funds between 2 countries. Based on the understanding and an informal but diligent process a netting off happens that results in all parties settling the transfer and receiving funds. Hawala is often associated with black money and terrorist financing by various government agencies and hence is a money transfer method which should best be avoided. Especially when the remittances costs are coming down every day and more and more legitimate options are available for users to pick and choose.

Exchange Rate IQ

The idea of this blog post was to give our users an overview of all different options for sending money across the globe from the USA.

With ExchangeRateIQ.com we plan to provide you with a detailed comparison of live exchange rates and fees from trusted banks & money transfer services. We currently cover close to 50 countries receiving remittances from the USA including major markets like India, Philippines, China, Mexico and other African, Latin American and south-east Asian countries.

You can check out ExchangerateIQ money transfer comparison tool and share your feedback with us.

Please let us know how did you like the blog post, did we miss something or any of the options that you would like to know more about. You can leave a comment below or send us an email at [email protected]."

Comments