Each year billions of dollars are sent by migrant workers to their home countries, with some estimates putting the total value of remittances at more than $500 billion.” “Dollars wrapped with love” as elegantly described by Economist Dilip Ratha, remittance is the transfer of money by the migrant to an individual in his or her home country. These are the personal savings of migrant workers/families that are sent back to home country for various reasons ranging from Savings to EMIs to parental support etc. This money not only makes a significant difference in the lives of those receiving it but also plays a major role in the economies of many developing countries. For a particular country outflow of capital is Outward Remittance and inflow of capital is Inward Remittance. Some amazing facts on Remittances –

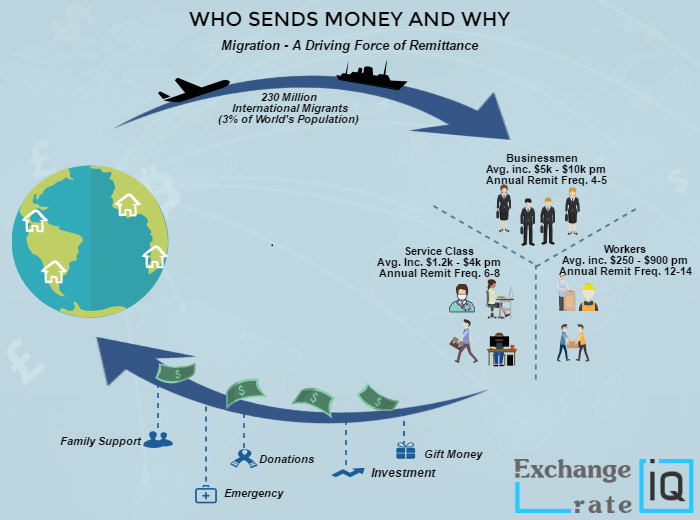

- According to a report by OECD, approximately 3% (230 million) of the world’s population resides outside their home country.

- In 2015, these 230 million migrants have sent $500 billion in the form of remittance to developing countries which is approximately 3 times more than the total global foreign aid which is $135 million.

- 10 % of the world’s population is directly affected by this money.

Impact of Remittance on the economy

Remittance is the second-largest source of foreign capital for developing countries and is considered as a hidden force which drives their economy. In 2015, India received the highest remittance that is $72 billion as reported by the World Bank, followed by China at $64 billion. The US emerged as the largest remittance source country with an estimated $56 billion in outward flow. The inflow of foreign capital in terms of remittance in developing countries has even overtaken the FDI. A small contribution from millions of people makes remittance a huge driver of the economy and hence it requires more focus from policymakers to simplify the inward remittance. For some developing countries like Egypt, Tajikistan remittances also make up a sizable portion of their GDP.

Major Remittance Markets

The remittance market is colossal in size with around $500 billion remitted globally in the year 2015. USA leads the chart for outward remittance by a huge margin over UAE closely followed by the UK. Over 42MM immigrants reside in the USA which makes up 13.3% of the nation’s total population. This population contributes to over 40% of the global remittance volume and has helped the US emerge as the largest source country for remittance over the years.

Countries Sending & Receiving Remittances

Major players: There are various services to transfer money overseas each one offering a different preposition – some offer fast transfers while others have low margins. Banks: Banks, being the experts in handling money, were the natural choice for people to transfer money overseas. Currently, the major banks in the segments are Wells Fargo, HSBC, ICICI and Citibank. But banks do not consider remittance to be a core banking service and hence lag on a host of other parameters like speed, cost, customer service and ease of sending/receiving money. This led to the evolution of dedicated remittance providers or more commonly known as MTOs (Money Transfer Operators). These companies simplified the process and captured substantial market share quite rapidly which even forced some major banks to exit or scale down their remittance offerings. Some such examples are JP Morgan Chase, Bank of America in the USA; Westpac in Australia and BBVA in Spain.

Incumbent Money Transfer Operators: Today the king of cross border money transfer is Western Union with a worldwide share of 15%. Some other top players are PayPal, MoneyGram, Ria and WorldRemit. They have well-established networks and systems in place to serve a large global customer base. But they offer less favourable exchange rates and charge high fees which have drifted customers towards other service providers.

Emerging Remittance Players: As world bank reported poor countries to lose up to $16billion every year due to high fees and restrictive services by a few firms. There are new entrants in the game like Remitly, Xoom, Transferwise, Currencyfair and Azimo which aim at low cost and easy practices as compared to the incumbent players.

Niche Money transfer Players: Products like Bitcoins, Mobile Top Up and Micro – Remittance i.e. sending small amount like $75 with a minimum fee, which forms the niche segment. Players like Bitpesa, Bitspark, Dahabshiil are working on such a niche segment.

Remittance top companies

The Cost factor

For all of its advantages, Remittance is something of a double-edged sword. The global average cost for sending money is around 8% and it goes as high as 12% for remittance-receiving countries like Africa. The Fee structure for Money Transfer Services seems to be like it is designed to milk the poor. These services charge a flat fee for a broad range of amount to be transferred. For instance, if an individual transfers $250 to his home country then the net amount received will be $230 only, after deducting applicable fee and service charges. Another problem is even if somebody wishes to send a small amount they end up losing a big share as a fixed fee. The most affected are those who want to send small amounts in frequent intervals as they lose a significant amount in terms of fees.

Cost of sending money across the border

Exchange Rate IQ can help !! The idea of Exchange Rate IQ is to get a single platform to identify, analyze and compare all available money transfer options between any 2 countries across the globe. These companies can thus be compared at different parameters like exchange rate, fees, transfer time, reliability, ease of use etc. This would help the users to find the best possible way to send money across the world. So, whether you are sending money to India or want to discover best USD to PHP exchange rates or want to find out options for remittances to Mexico, ERIQ can help you find answers to all your questions. We promise complete transparency, unbiased results and clutter-free comparison of the money transfer companies, for all the migrants across the globe. Stay tuned for our next blog for more details!!"

Comments